When Innovation Is Expensive

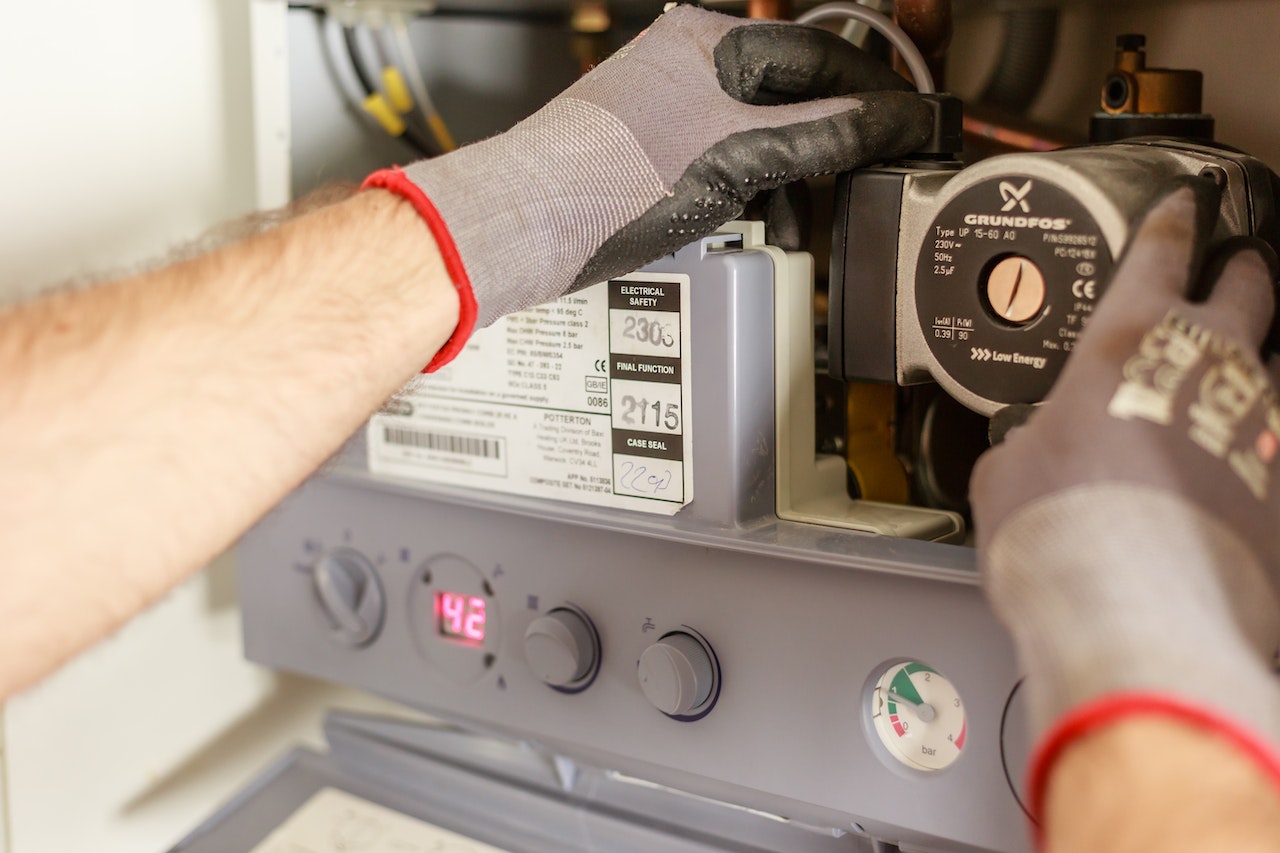

Embracing growth and pursuing innovation necessitates investing funds into the business. After conducting a review, the team identified the imperative for making substantial changes to processes and services, entailing significant implementation expenses. Nonetheless, stagnation could result in forfeiting the position as the top plumbing company in the region.

Opting to establish the necessary foundations for the company’s excellence was an evident choice. However, conducting thorough research becomes crucial to ensure the availability and prudent allocation of funds to the right initiatives.

Amount of Money Needed to Update

Upon recognizing the company’s need for updates, the owners swiftly assessed the costs linked to these changes. Ultimately, the upgrades for the plumbing company would encompass an expansion of their vehicle fleet, acquisition of additional equipment, and hiring of more workers. Consequently, collecting the necessary funds for these enhancements without affecting profits presented a significant financial challenge.

After consolidating all essential resources, the business definitively calculated that approximately $300,000 would be necessary to complete the comprehensive updates and maintain their esteemed status as the top plumbers in the country.